After a three-hour public hearing and strong citizen opposition, the Whitesboro City Council voted against their initial proposal to increase property tax rates last Friday night.

In a packed room that overflowed into the City Hall lobby, the council held two public hearings: one regarding the budget and the other regarding a proposed 25% tax hike.

The public hearing for the budget began with a PowerPoint presentation by City Administrator Julie Arrington who addressed several questions she had been receiving from citizens in the past week. The presentation showed an overview of the historical tax rates for Whitesboro, what the rate would affect, the city’s current account funds and city expenses, current obligations and debt.

“The budget under [our current] tax rate cannot replace what [is to be] spent over this next year,” Arrington said. “My predecessor did a really good job of saving us money, but some of our assets, as you see, really need some attention, and so it’s taking our money.”

Following Arrington’s presentation, Mayor Dave Blaylock opened the floor for citizens to address the council on the proposed budget. At that time, longtime resident and former councilman Colby Meals expressed concerns about inconsistencies and waste he saw in the budget. Meals pointed out that approving the proposed tax rate increase would only gain the city a total of approximately $420,000. He claimed that two projects on the budget in particular (a new public safety building and a remodel of City Hall) could wait another year and would alone cover the cost of the tax rate increase, making it unnecessary.

“You haven’t done your job as leaders,” Meals said. “You have not done your job to understand and research this budget in detail, and now we the citizens are the ones who are going to pay for it.”

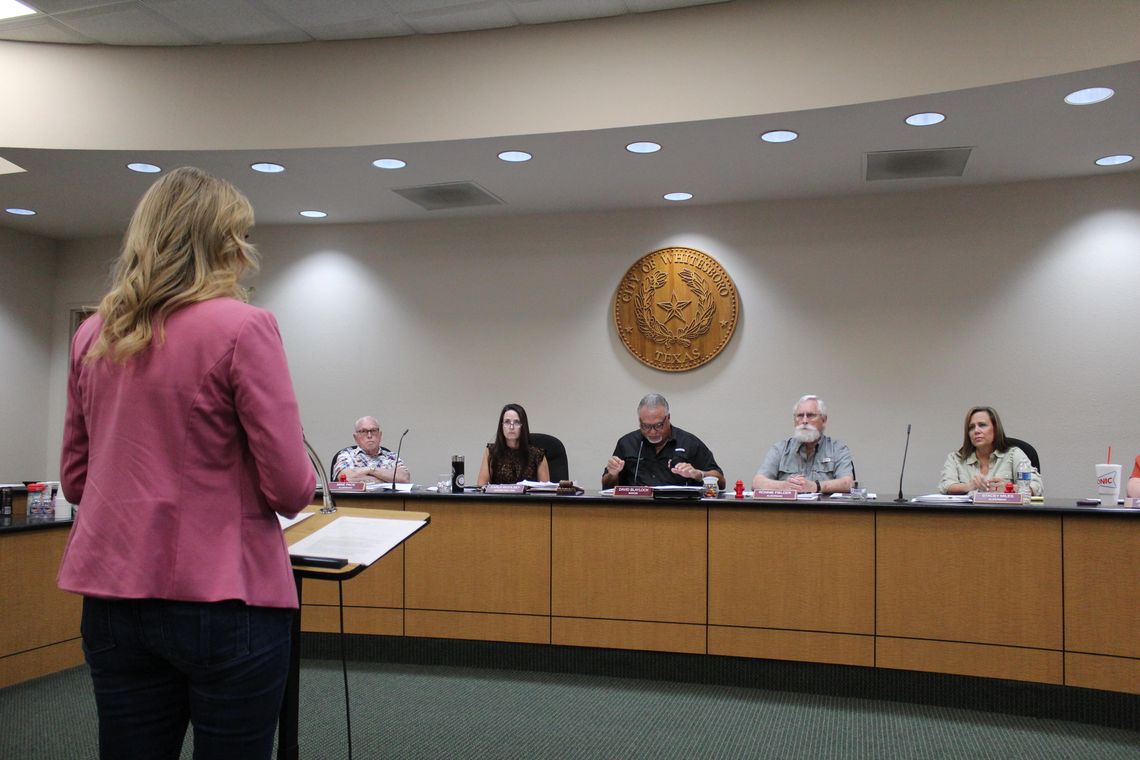

Following the public hearing on the proposed budget, Blaylock opened the public hearing for the proposed tax rate. Several citizens took the podium to address the council and voice their opposition to the tax increase.

“We as a whole in this community are struggling along with the rest of the nation,” lifelong Whitesboro resident and business owner Barry Beste said, citing today’s high food cost, housing, insurance and utility prices. “Please reconsider the tax increase on the citizens of this great community.”

Single mom Holly Kolbo reminded the council about the tax increase the recent school bond brings. She said this plus today’s high prices are a huge burden for local families.

“Some may say that it’s only a few hundred dollars added to our property tax bill,” Kolbo said, “But when [the value of our home] has been overinflated, this amount becomes unsustainable.”

After 20 minutes of citizens voicing their opposition, the last person to take the podium was Shelly Luther, Texas House of Representatives candidate.

“With property values going up, you’re already getting a raise,” Luther said. “You’re actually getting an opportunity to lower the tax rate because you’re already getting a raise from the higher property values. Please take that into consideration.”

The mayor then closed the public hearing and council prepared to vote on the budget. However, it then became known that this budget was not posted online for citizens to review.

“So we the citizens have not been able to see this budget that you’re about to vote on?” Meals asked. Arrington confirmed.

Currently, the city property tax rate is set at .39 (39 cents per $100 home valuation). Arrington explained that the council originally proposed an increase to .519. Then, after a public hearing held on Sept. 17, the council asked to see a budget reflecting a tax rate of .49. Arrington created a new budget based on that tax rate, and then posted it to the city website for citizens to review. This was the budget that citizens came prepared to discuss at Friday’s public hearing.

In the meantime, council asked to see a new budget determined by a tax increase of .44 that was not posted beforehand. This was the budget being presented and discussed by council at Friday’s public hearing. Arrington offered to print copies to pass out to the audience but reminded everyone that council had to adopt the budget by Sept. 29.

This brought some rumblings throughout the audience as people realized that not only did citizens not have a vote on the budget, but the council was already planning on voting on a tax increase. As tensions rose, the council opened the floor for discussion.

“One item that could be easily changed is put it back to the regular tax rate, and that’ll change everything back to normal,” Luther said. “Give us the numbers on the current tax rate.”

The council went into Executive Session to consult the city attorney. An hour later, they returned to Regular Session and continued the discussion on the budget. Arrington led a presentation of the budget at the .44 tax rate, a 10 percent increase from today’s rates.

Ultimately, the council agreed to adopt the budget to whatever tax rate would be adopted later in the evening. Next, the council had to vote on the tax rate.

“I just want to say that I appreciate all of you for coming out to these meetings and I wish you would come to more of them. It’s beneficial for us,” Alderman Stacey Miles said. “I also think that raising taxes is not beneficial to the people of Whitesboro at this time. Therefore, I move that the property tax remain at the No New Revenue rate of .387645.”

A roll call vote was unanimous. Alderman Su Welch was not in attendance.